The topic of literary forgery in the eighteenth century and Romantic period has become something of a boom industry in the last few decades.

Since I published my own studies on this theme in the 1980s (The Making of History and Faking It), scholarly interest in this area has burgeoned and has contributed much to the remapping and redefining of literary history in this period. One reason for this renaissance is undoubtedly that the eighteenth century is so rich in primary sources. The literary forgeries of the “big three” still continue to fascinate scholars: I refer here of course to James Macpherson, who invented an ancient Scottish epic poet called Ossian; Thomas Chatterton, the boy wonder of Bristol who fabricated a series of poems and other documents supposedly written in the fifteenth century; and William Henry Ireland, who “discovered” a new play by Shakespeare, Vortigern and Rowena. Some of the scholarly interest in these figures and other forgers has been motivated by nationalistic affiliations: the “Ossianic Celtic revival” has produced solid studies by, among others, Fiona Stafford and Howard Gaskill, while Mary Ann Constantine has recently championed the Welsh antiquarian scholar-forger Iolo Morganwg (Edward Williams). Other work has perhaps been stimulated by post-Foucauldian concerns about the vexed yet intriguing relationship between creative authorship, originality, and authenticity. As Debbie Lee notes in her chapter on “Forgeries” in Romanticism: An Oxford Guide (and this inclusion is itself symptomatic of the resurgence I am describing), “One of the things impostors and forgers make strikingly clear is the period’s idolatrous worship of authenticity and truth” (521). Chief among the iconoclasts determined to expose Romanticism’s “idolatrous worship of authenticity and truth” is Nick Groom, whose book The Forger’s Shadow (2002) represents the most sophisticated and searching re-evaluation of the impact of forgery on our conceptions of authorship and authenticity. Groom goes so far as to state that Romanticism “(for want of a better term) would have been very different without literary forgery—indeed it may not have recognisably existed at all” (Forger’s Shadow 15); hence the subtitle of his book, “How Forgery Changed the Course of Literature.”

Groom’s book, together with recent studies by Debbie Lee, Margaret Russett, Jack Lynch and Robert Miles provide clear evidence that forgery studies have expanded well beyond those paradoxically-defined “original” fakes of the Big Three (supposedly ancient or renowned works of the past actually authored in the present and as such qualifying as new, “valid” creative texts). Forgery now embraces aspects of canonical authors’ poetic practice (such as plagiarism), but increasingly there is an interest in the colourful cases of exotic hoaxes and imposture, a tradition which begins with the sprightly career of the “Formosan” rogue George Psalmanazar. Indeed, the Romantic impostor has graduated into the heroic performer of Butlerian, transgressive gender and identity politics, most notably in the examples of Joanna Southcott (who claimed to be the bride of Christ) and the servant Mary Wilcox/Baker, alias “Princess Caraboo of Javasu.” As Groom remarks on Debbie Lee’s Romantic Liars: Obscure Women who became Impostors and Challenged an Empire (2006), “Lee’s impostors are women who disguised themselves to create social opportunities, which they lacked through gender and class prejudice” ( “Romanticism and Forgery” ). This cast of Romantic impostors continues to grow and is not restricted to one gender. One important and lively figure whom Lee overlooks and who takes the theme of forgery into the furthest regions of the British Empire is George Barrington, a celebrated “Prince of pickpockets” who was transported to Australia in 1791 where he supposedly wrote several pioneering biographical accounts of Botany Bay and New South Wales. As Nathan Garvey’s excellent study shows, these influential books were actually fabrications produced by unscrupulous publishers cashing in on Barrington’s celebrity.

As these examples demonstrate, the subversive credentials of forgery continue to generate historical curiosity and scholarly passions. In Groom’s words, literary forgers are “by turns spectral, mad, illegitimate and elusive; vilified, criminalised, excluded from the canon” ("Romanticism and Forgery"). However, one area of Romantic forgery which remains under-explored is financial forgery; to be precise, the massive counterfeiting of banknotes which emerged from the credit crisis of the Romantic period. The contemporary tone of the phrase “credit crisis” is quite intentional, as there are some striking (if depressing) parallels between the collapse of faith in paper money which occurred in the early nineteenth century and the current desperate measures to restore faith in an international monetary system based on credit and colossal levels of national debt. In one sense this recurrence attests to Romanticism’s failure to prevent credit becoming (in Brantlinger’s words) “a basic, unavoidable aspect of modern money and modern economic processes” (139) yet, as Brantlinger’s fine study shows, the Romantic period saw some of the most illuminating analyses of credit by both its supporters (such as Coleridge) and its radical critics (such as Blake, Cobbett and Shelley) (114-35). The stakes were extremely high: the controversy about credit struck not only at the roots of national wealth and security but also at the emerging idea of culture as a civilising force which both resisted and transcended commercialism. “Paper” was therefore a massively ambiguous symbol of both the fraudulent power of the state and the democratic medium of print culture and the press. If the problem for Romantic writers was to try to reconcile this contradiction, one course of action was relatively easy: if “paper” was illusory and dangerous, critics of credit could restate their faith in “real” gold and silver. But a remaining concern for “currency radicals” (Poovey 220) was that the rejection of what Cobbett called the “paper promises” of a debt-ridden system did not necessarily reveal a new source of value outside the (dis-credited) economy: what would be the literary or cultural manifestation of the absent gold standard? Hence the Romantic credit crisis may well have sharpened and deepened the Romantic quest for an “egotistical sublime” and a redemptive concept of culture uncontaminated by materialism, conformity and commodification (Williams, chapters 1-2).

However, it was not the suspension of cash payments alone but another controversy which pushed the paper-money scam to the forefront of public debate: the spectacular increase in the number of executions for forgery. It was the severity of Britain’s “bloody” penal code which heightened and inflamed public opinion about the invidious connections between paper money and unreformed political power. This theme has been neglected by scholars of both Romantic forgery and the credit crisis, so it is to be hoped that the essays in this volume will open up some new lines of investigation and provide some interesting case studies. For opponents of paper money the public execution of hundreds of lower-class victims of petty forgery crimes (the handling of fake one-pound banknotes) was a spectacular display of the evils of an unreformed state which relied on a credit economy to pursue its goals. As the essays in this volume show, the shockwaves of these judicial crimes reverberate throughout the literature and culture of the Regency period and beyond—all that is needed are the methodological sensors to detect the tremors.

My own interest in Romantic financial forgery takes up in a quite literal way the idea that forgery spectacularized the contradictions of the credit economy. The anti-hero of my essay is not the literary forger or bravura impostor but the spectral figure of the engraver: the generic producer of, on the one hand, both genuine and counterfeit currency and, on the other, the “shadow” economy of popular graphic caricatures. By giving the forgery controversy a visual turn, I show that Romantic-period anxieties about authenticity and value achieved a form of visual apotheosis through the “formidable” power of the caricaturist (and the source and significance of that word “formidable” will be revealed later). I propose that Romantic-period caricature actually flourished within the credit and forgery crisis, finding a fertile cultural climate for its own paper economy of “fake” or falsifying representations, and exploring in an inimitably effective way the dubious logic of a system built on “paper promises.”

Romanticism and Restriction

Of Augustus and RomeThe poets still warbleHow he found it of brickAnd left it of marble.

So of Pitt and of EnglandMen may say without vapourHow he found it of goldAnd left it of paper.

Cited Ehrman, 11.

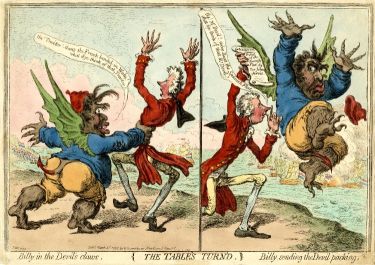

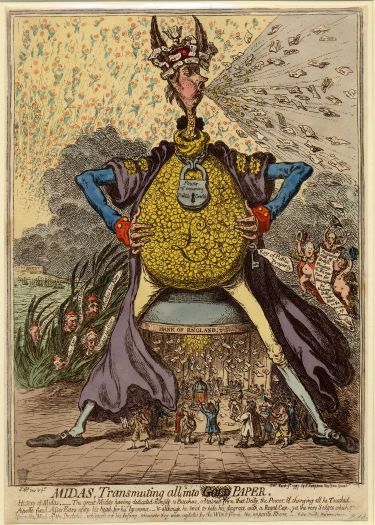

On 25 February 1797, “a day which will long be remembered”, according to William Cobbett (149), Prime Minister William Pitt went to see the King for an emergency meeting. The country was in a state of national alarm, as news had just arrived of a French invasion at Fishguard. In fact this turned out to be easily repelled (Figure 1), but the incident forced Pitt to consider an option he had resisted for some time. Fearing that there would be a run on the Bank of England which would in turn damage the financing of the war against France, he persuaded the King to issue (what turned out to be) a momentous decree: starting immediately, the Bank would no longer issue specie (cash or metal currency) in exchange for paper banknotes. The Bank Restriction Act, as it later passed into law, is a somewhat misleading title, as it actually led to a massive expansion of paper money. Specifically, the Act authorized the mass production of new £1 and £2 banknotes to replace the withdrawn specie, and it was this literal cheapening of the currency which would prove to be so disastrous in its social consequences. The explosion of paper money was seized on immediately by James Gillray, the period’s leading caricaturist. In his wonderful print Midas, published just a few weeks after Restriction came into force (Figure 2), Pitt is shown as a colossus squatting over the Rotunda of the Bank of England which serves him like a toilet. From both his rear end and his mouth Pitt is showering the Bank with the new low denomination notes which also make up his paper crown. We will return to this image throughout this essay as it forms one of the most iconic responses to the credit crisis, matched only by George Cruikshank’s Bank Restriction Note which we will meet shortly. Note that Gillray foregrounds Pitt’s megalomania and plays down the culpability of the Bank: obviously, at this very early stage he could not have foreseen the Bank’s role in securing convictions for forgery and the ensuing public outrage this engendered. Originally, Restriction was meant to last only six months, but as the credit crisis persisted the Act was renewed continually until specie payment was eventually reintroduced in 1821, by which time the national debt was an astonishing £854 million, or 2.7 times the national income (O’Brien 179). During its 24-year reign (which dovetails quite neatly with a large slice of the Romantic period), Restriction provoked a storm of controversy which is still under-valued in Romantic studies. Though the topic is mentioned in a number of books on forgery, the issue of forgery remains marginal in the seminal studies of the role of credit in British culture.

But in light of the fact that, as Margot Finn notes, an “aversion to paper money” was “deeply rooted in Georgian England” (80) this theme clearly deserves more exploration.

There were two major problems with Restriction. The first was that it seemed to undermine the very system of credit which it was supposedly safeguarding. Charles James Fox called the stoppage of cash payments “the first day of our national bankruptcy” (Richard, 1: 84). But, as we shall see, the Restriction crisis actually exposed deeper contradictions which had bedevilled the British “financial revolution” from its inception in the Restoration period (Dickson, chapters 1-2). The second problem with Restriction was more visible and sensational: London (the primary zone within which the new low denomination Bank of England notes circulated) saw a massive increase in executions for forgery.

This catastrophe had three main causes. First, the vulnerability and gullibility of the lower classes who were unused to dealing with banknotes.

Before this time forgery had been largely a white-collar crime. The best-known eighteenth-century forger was probably the Reverend William Dodd, who was executed in June 1777 for forging the signature of his former pupil Lord Chesterfield on a banknote valued at £4,000. Despite Dr Johnson coming to his aid and writing his pleas for clemency, and despite a large petition of 30,000 signatures in his favour, Dodd went to the gallows. As Boswell puts it in his Life of Johnson, Dodd had committed “the most dangerous crime in a commercial country” (828).

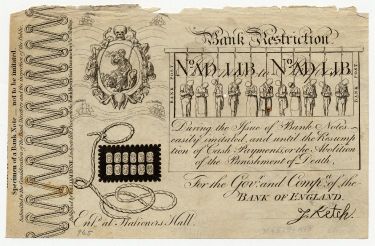

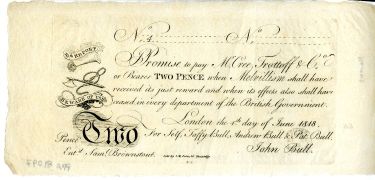

The second contributing factor to the rise in Restriction forgery was the poor quality of the banknotes which made them easily counterfeited (Figure 3). The third factor was something which Gillray could not have foreseen: the ruthlessness of the Bank of England - the “head of all circulation” - in prosecuting offenders.

Indeed, the Bank employed a team of lawyers at great expense to ensure prosecutions. The statistics are dramatic: the period 1783-97 saw only four prosecutions for forgery, but 1797-1821 (the Restriction period) saw over 2000 prosecutions and over 300 executions. The Bank spent thousands of pounds to secure these executions, and in some years such as 1819 this amounted to more than was lost through forgery (McGowen para 4). Almost one third of all executions at this time were for forgery, but the vast majority of these were concentrated in the post-Napoleonic war period, when economic depression and demobilization of thousands of troops and sailors produced ever greater incentives for the forger (Handler, “Forging the Agenda” ). When the government reneged on the original promise to abolish Restriction after six months of peace (which eventually came in 1815), public hostility to the growing body count of convicted forgers and handlers (or “utterers”) became vitriolic. James Mackintosh spoke in parliament of the “course of guilt and blood which had followed the stoppage of cash payments”

while Henry Brougham railed at the “human sacrifices to the Moloch of Paper Credit.”

The resurgent radical press—perhaps drawing on memories of similar injustices against the plebeian body, such as the Waltham Black Acts against poaching, or the widespread practice of press-ganging and crimping - persistently and sensationally exposed the injustices of the forgery trials. Thomas Wooler’s Black Dwarf declaimed that “homicide has been legalized” to defend “the paper bubbles which are dignified with the name of currency” (2 [9 September 1818], 561). In 1818, when almost 30,000 fake banknotes were in circulation, public sympathy for the hapless plebeian forger led to numerous acquittals.

Doubts were also expressed about the competence of the Bank of England in recognising a fake from the real banknote. As early as 1814 an anonymous caricature called A Peep into the Rag Shop in Threadneedle Street highlighted this theme. The print shows a poor forger pleading with Bank of England directors who are examining a bank note. As the speech bubbles make clear, behind their callous bluster is dire ineptitude: ‘“Upon my soul I have my doubts but at all events—we had better declare it bad.”

“Take him out Thomas !!! he has a d----d hanging lok.”

“Away with the Vagabond! Do you think we sit here for nothing!”’ By the late 1810s, therefore, forgery was no longer, in Handler’s words, a “uniquely subversive” crime which undermined what William Wilberforce called the “vital principle of a commercial nation”, but a dramatic exposure of the eighteenth-century “bloody code” (Handler, “Forging the Agenda,” 264, 263). The response of both the Bank of England and the government to this barrage of criticism was characteristically insensitive: rather than campaigning for leniency, they both launched inquiries aimed at finding a foolproof or “inimitable” design for the banknote. However, the clamour of public opinion was proving to be a formidable force and in 1819 official moves began to review both Restriction and capital punishment.

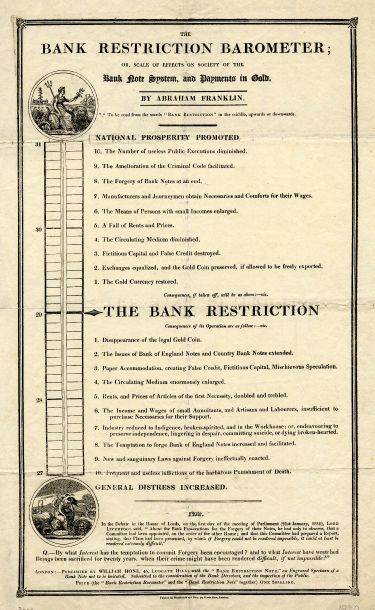

There could have been no timelier a moment than January 1819, therefore, for the radical publisher William Hone and the leading Regency caricaturist George Cruikshank to issue their own “inimitable” contribution to the Restriction controversy. The Bank Restriction Note and its companion piece the Bank Restriction Barometer (Figures 4 and 5) were published just days after the Bank of England’s inquiry concluded that a forgery-proof design had to be robust enough to withstand the “formidable power of imitation” of the engraver (Times, 27 January 1819). Hone and Cruikshank undoubtedly appreciated this ironic tribute to their joint production, as the Bank Restriction Note takes the form of a mock-submission to the inquiry.

Unlike earlier satirical banknotes which resembled actual counterfeits (Figure 6), the Hone-Cruikshank caricature is more than just a “formidable” imitation which exposes the flimsy authenticity of the original. By using visceral and witty gallows symbolism, Hone and Cruikshank inscribed into the banknote the catastrophic social consequences of its circulation: what Black Dwarf called the “blood-cemented fabric of paper currency” (2 [14 October 1818], 611). Reminiscent of the “blood sugar” anti-slavery propaganda of the 1790s, the Bank Restriction Note defamiliarizes and demonizes everyday consumption, transforming banknotes into emblems of blood money: satirically, this is their true appearance and true value (the Bank’s role as surrogate executioner is evidenced by the replacement of its clerks’ signature with that of Jack Ketch, the notorious hangman of the 1680s).

The national calamity of Restriction can be gauged by comparing Gillray’s efflorescent vision of paper-money inflation with Hone and Cruikshank’s single banknote: with hindsight, Pitt becomes an apocalyptic monster of destruction, spewing out seemingly innocuous and ephemeral scraps of paper which are actually seeds of future calamity. Put another way, Pitt is spreading his malign influence over the Bank to ensure its compliance in devastating the lower classes, those absent or proleptic victims of the new dispensation (Pitt puts John Bull in the Rotunda but he is clearly incongruous). The Midas legend is brilliantly if ironically apt, as the new notes will bring death to those who touch them and ‘restrict’ the body politic in the most debased way possible. Seen in conjunction with Cruikshank’s caricature, the full significance of the catastrophic transformation of “value” under Restriction becomes terrifyingly apparent. In a series of mock-mythic metamorphoses, a whole national narrative of modernity and progress is unravelled: gold transmutes into paper, paper into its forged “shadow”, and this phantom form of circulation is re-incarnated into the “blood” of the nation, an inverted symbol of national well-being. The function of currency as both the literal and symbolic signifier of national wealth and security is systematically dis-credited by satirically re-encoding its semiotic processes as both fantastical and lethal—as if currency is the Gothic alter-ego of caricature itself.

The Hone-Cruikshank prints were an instant success and undoubtedly contributed to raising or inflaming public awareness about the evils of both paper money and capital punishment.

Significantly, it was in 1819 that Peel’s Act finally promised the restoration of specie payment by 1823 (though this was achieved by 1821, when Britain formally adopted the gold standard), and during the same year a parliamentary inquiry into capital punishment focused on forgery as one of the main reasons for reforming Britain’s harsh penal code. In his old age Cruikshank claimed that his print had single-handedly led to the abolition of the death penalty for forgery 13 years later, an exaggeration though a forgivable one.

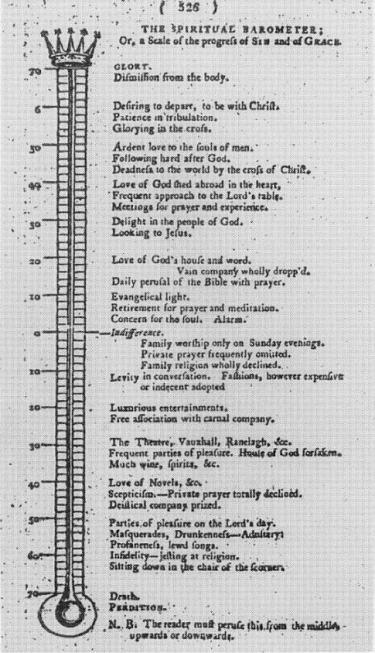

But the spectacular achievements of the Bank Restriction Note should not be allowed to overshadow the quiet power of its companion print the Bank Restriction Barometer. Clearly, this print takes a different approach to its companion piece’s mimetic wit. At first sight the Barometer appears to be a simple visual illustration of the radical argument that over-investment in paper currency leads to national ruin, but the satirical dynamic is more complex than this. Many viewers in 1819 would have recognised that the print was a close parody of the Evangelical spiritual barometer of the late eighteenth century (Figure 7). In the caricature, the salutary function of the vertical scale is inverted: the overheated economy replaces sublime spiritual redemption and the gravitational security of gold replaces the sins of the flesh (and note that novel reading is calibrated at minus 40!). This parodic allusion makes clear that the satirical target of the Barometer is the quasi-religious “faith” in paper money which, as we shall see, both underpinned and troubled the “financial revolution” from its Williamite origins. But the process of allusion does not end there, as the spiritual barometer first appears in Hogarth’s anti-Methodist caricature Enthusiasm Delineated (Figure 8). The echo of Hogarth is, I believe, a self-authorizing reference to the English caricature tradition which first accrued substantial cultural authority by critiquing the new monied interest of the early eighteenth century. Like the fake banknote, the satirical print shadowed, mirrored and exposed the new credit economy throughout its history.

Gold into Paper

The Restriction controversy was the breaking point of an ideological instability which lay at the heart of the paper money system. If the Romantic period was haunted by what Shelley in The Mask of Anarchy called the “ghost of gold”,

the earlier eighteenth century was haunted by the transubstantiation of paper. When Charles James Fox remarked that “the solidity of Notes consisted in their being convertible into cash” (Times, 1 March 1797), he identified that magical process of transformation which underpinned the credit economy and which could maintain the illusion that banknotes were “solid” rather than ephemeral and insubstantial. To its many critics, Pitt’s Restriction Act of 1797 jeopardised the nation by undermining the system of credit and national debt which it was supposedly trying to protect. It was this system of deferred payment which lay behind the creation of the Bank of England in 1694 and which allowed Britain to finance wars and imperial gains well beyond its actual stock of bullion—as Roy Porter puts it succinctly, “Britannia”s wars were won on credit” (132). The genius of the “financial revolution” was that it utilized the foundational economic metaphor of circulation to naturalize and anthropomorphize convertibility:

In this imaginary, paper money is the blood which periodically returns to the heart (the Bank’s bullion), to be then pumped out into further circulation, revitalized with “real” value. In the words of one of Thomas Love Peacock’s Paper Money Lyrics:

The paper money goes about, by one, and two, and five,A circulation like the blood, that keeps the land alive.

“A Mood of My Own Mind”, in Peacock, 16.

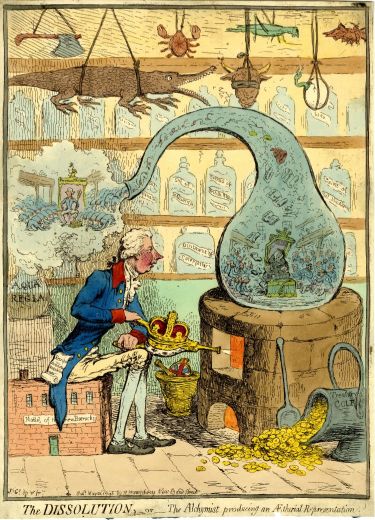

According to the circulatory or anatomical model, the body politic functions healthily so long as this flow of money is neither “restricted” nor inundated: if one nightmare is economic starvation (as seen in the stereotype of the emaciated French), the other danger—as Gillray imagines—is the inflationary overproduction of worthless and wasteful currency. Another way to read Gillray’s Midas is as a scatological parody of the famous cover illustration to Thomas Hobbes’ Leviathan (Figure 9): instead of the monarch comprised of his people, Pitt’s body is a sack of secreted and hoarded gold; the literal and symbolic wealth of the nation becomes the tyrant’s booty, replacing citizens with financial chicanery (Pitt’s incontinent largesse also, unavoidably, brings the current dis-credited euphemism “quantitative easing” to mind). However, behind Gillray’s scatological effects lies a more acute point: by evoking the Midas legend, Gillray exposed the alchemical delusions and perils of the myth of convertibility—indeed, the critique was anticipated in a print of 1796 (Figure 10) which shows Pitt as a megalomaniac alchemist who is converting the national wealth into a throne for himself. As Gillray understood, it was the magical properties of paper money which mystified both economic and political power. Even political economists (whether supportive or not) invariably resorted to pre-enlightenment tropes of what Marx called “primitive economic superstition” (261): alchemy, allegory, magic, blind allegiance. Debacles like the South Sea Bubble and the John Law Mississippi scheme (both collapsed in 1720) fuelled the idea that paper credit was a powerful and potentially dangerous illusion.

Daniel Defoe referred to paper money as a “chimera”; Thomas Mortimer called credit a “standing miracle in politics, which at once astonishes and over-awes the states of Europe” while later in the century Benjamin Franklin boasted that the “wonderful machine” of “paper currency” (in this case the dollar) had enabled America to defeat Britain.

Like its over-valued material form, the ideological “miracle” of paper credit required constant investment and re-investment. For all its glaring conceptual weaknesses, the financial revolution became an epistemological revolution: in Pocock’s words, the switch to deferred payment was a “momentous intellectual event.” By locating value in an endlessly receding future, credit changed the whole basis of the individual’s relationship with the state, replacing civic humanist duty with an “imagined” community of desiring individuals.

As Brantlinger has shown, this destabilization of what Marx called species being (though perhaps “specie being” is a more appropriate coinage in the current context) both afflicted and empowered the literary imagination (114-35). At the same time as the new monied interest became a regular target for satire, attempts to relocate value outside of the paper economy proved to be difficult and often equally reliant on cultural mythologies: Romanticism’s resort to primitivism (Wordsworth’s “natural” language of the lower classes), and radical nostalgia (Cobbett’s banknoteless past) are just two prominent examples.

Alchemical or transubstantiational delusions were not the only obstacles preventing the full assimilation of paper money into Enlightenment modernity. The “momentous” transition to the credit economy was also undermined by the spectre of forgery. This was both a literal and figurative threat. From its inception, paper money was shadowed by forgery: the first fake banknotes appeared in 1695 within months of the genuine issue.

But the greater damage was ideological, as forgery exposed the essentially imaginary or fictive status of the supposedly authentic original (and it is worth a reminder that a banknote is of course a simulacrum, a copy of a non-existent originating source; there is no such thing, except conceptually, as a unique, single banknote from which copies (legal or illegal) are taken). As Paul Baines notes, “The whole system could be typified by the forgery it naturally engendered” (14). Faced with this perplexing intimacy between financial good and evil, the difference between supporters and critics of the new “system” could only be theological: supporters believed the fiction (or refused to question it), critics exposed it.

A characteristically ambivalent attitude to paper money can be seen in Joseph Addison’s third Spectator essay (Saturday 3 March 1711). The essay takes the form of an allegorical dream vision of the goddess Credit, a deity who sits on a throne in the Bank of England, surrounded by “a prodigious heap of bags of money” and pyramids of gold piled to the ceiling. It is likely that Addison is alluding to the image of Britannia “sitting and looking on a Bank on Money” which was the logo of banknotes from their earliest issue (Keyworth) and which reassuringly emblematized the “real” value of the note in bullion. Hence Addison likens Credit to the “Lydian king”; Credit can “convert whatever she pleased into that precious metal”—in other words she is a transgendered Midas who guarantees the nation’s wealth with her miraculous powers of transformation. However, at the first sign of political and social unrest the goddess shrivels into a skeleton, the bullion becomes “bags full of wind” and the gold changes into “heaps of paper.” Only when order is restored is the goddess resuscitated and restored to her former beautiful but “delicate” constitution (The Spectator, 1: 17-20).

Addison’s nervous allegory of the politically unstable rise of paper rule (a “bag full of wind”) was a vivid and influential expression of residual Enlightenment scepticism towards the new faith of “speculative fantasy” (Nicholson 10). Alexander Pope delivered a poetic broadside against the new orthodoxy in Epistle III: To Allen Lord Bathurst (1733-4):

Blest paper-credit! last and best supply!That lends Corruption lighter wings to fly! (Butt, 254; lines 69-70)

David Hume referred to paper credit as “counterfeit money” (173), while Adam Smith in The Wealth of Nations had to apologize for using “so violent a metaphor” when he compared paper credit to “a sort of waggon-way through the air”, a fantasy of elevated economic activity which he was obliged to qualify by reworking Pope’s trope of tainted flight: ‘The commerce and industry of the country, however, it must be acknowledged, though they may be somewhat augmented, cannot be altogether so secure, when they are thus, as it were, suspended upon the Daedalian wings of paper money, as when they travel about upon the solid ground of gold and silver. (1: 484)’ If the Midas legend provided an aptly mythological vehicle for dramatising the miraculous powers of convertibility, the Icarus myth added the elements of ambition, risk and catastrophic failure. The perils of putting all the nation’s financial eggs into the flimsy basket of credit became only too apparent in the Gordon riots of June 1780. When the Bank of England was attacked, the country faced the prospect of financial ruin: ‘Let any rational mind figure to itself the confusion that must have ensued, the ruin that would have been spread, the distresses in which orphans, widows, natives, and foreigners, persons of all ranks and conditions, in whatever station, in whatever employment, would have been involved, by the annihilation of so many hundreds of millions of property, and the total abolition of all public credit! Who can but for a moment think on the danger, without looking up to heaven in grateful acknowledgment to the Supreme Being for so signal a national deliverance? (Gentleman’s Magazine, 50 [July 1780], 312)’ But if “public credit” narrowly survived the century’s worst outbreak of civil disorder, it faced an even greater threat in the wake of French revolution. On this occasion, the price to be paid for “national deliverance” was regarded by many observers as unacceptably high.

John Bullion

By the revolutionary 1790s, the idea that “public credit” faced an imminent “Daedalian” disaster became a powerful rhetorical tool in anti-government writing. In The Rights of Man (1791-2), Thomas Paine noted that the “English system of funding” was close to bankruptcy; in order to finance overseas conflicts, Britain was “increasing paper till there is no money left” (133). As the war-torn decade progressed and the national debt grew, Paine realised that the principle of convertibility was about to collapse. From this point on, radical discourse configured paper and gold as class enemies. In his pamphlet Decline of the English System of Finance, published one year before Restriction in 1796, Paine predicted that gold and silver were about to “revolt against depreciation and separate from the value of paper”, in the process destroying the “popular delusion” of the credit system (Foner, 2: 661, 651-2).

The Restriction Act must have seemed to many a fulfilment of this prophecy and a major boost for the radical critique. The iconoclastic discourse of transparency penetrated so deep into radical thought that it can even be found in a fugitive document issued by the shadowy insurrectionary group the United Britons in 1799. The document calls the English political system as an enormous “Fraud” and adds that ‘Amidst mock Contentions for Liberty, and real ones for Plunder, [England] vainly imagined herself free, and was thereby induced to pay the Interest of a Debt of greater Amount than the Value of the whole landed Property of the Country, without reflecting that Bankruptcy, however late, must be the consequence of an overstretched Credit. That Bankruptcy has arrived. (Report of the Committee of Secrecy, 68)’

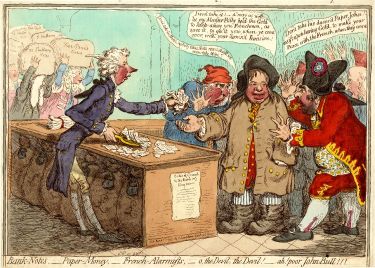

Alongside the oppositional analysis, caricature added its own distinctive contribution to the debunking of credit by imagining a new national narrative of conflict between the people and the government: John Bullion versus Paper Pitt. In Bank Notes (1 March 1797), Gillray’s first response to the Restriction Act, John Bull is a hapless yokel caught between the insidious “bullionist” temptations of the Jacobin Foxites and the spectacular “paper” rip-off of Pitt and his ministers (Figure 11). Characteristically, Gillray mocks all three parties and leaves the viewer uncertain about which is the greatest offence: Fox’s disloyalty, Pitt’s tyranny, or Bull’s idiocy. Bull decides “a’ may as well let my Measter Billy hold the Gold to keep away you Frenchmen, as save it, to gee it you, when ye come over, with your domn’d invasion”, but this reluctant compliance with the lesser evil does not defuse the satirical gusto with which Gillray depicts the “delusion” of paper money: the stash of padlocked money bags beneath Pitt’s counter constitutes both a mock-patriotic bulwark against the French and a new symbol of centralised state power (hence in Midas one such money bag is used for Pitt’s body). The hapless Bull fails to notice that in the background ministers are delivering sacks of increasingly low-denominational notes (including one labelled “one shilling”). Their worthlessness is brilliantly echoed in Pitt’s use of an inflationary scoop, a satirical inversion of the Bank of England’s supposedly authoritative and measured release of currency into the economy. Seen alongside Midas, this print anticipates the dangerous consequences of the Restriction Act for the plebeian classes: in another telling touch, John Bull’s coat-buttons look perilously like gold coins, a tempting prize for the voraciously asset-stripping government. Before very long, as we shall see, the caricature narrative of John Bullion’s victimization will take on a much more violent form.

As the cases of forgery multiplied and Restriction became more and more unpopular, the lethal rift between “real” money and paper “delusion” became increasingly exposed in both radical polemic and the caricature imagination. The most successful single radical intervention was almost certainly William Cobbett’s bestseller Paper against Gold, first published in his newspaper the Weekly Register as a series of open letters, and subsequently issued in book form in 1815. Cobbett argued that only “real money” had “real value” (96), but in stating this he was only echoing the Bullion Committee report of 1810 which called cash payments the “natural and true control” against paper inflation.

This re-naturalization of gold and demonization of paper gave an additional force to Hone and Cruikshank’s debunking of the official iconography of the nation state in their Restriction Bank Note. Instead of depicting Britannia staring at a beehive, a symbol of industriousness which replaced the earlier pile of gold, the satirical Britannia is shown as an unnatural mother eating her children, an apt illustration of the state’s dereliction of duty (Figure 12). Reminiscent of the liberticidal monsters of anti-Jacobin caricatures, this grotesque figure reveals that such symbols of authority are now (in Cobbett’s words) a mere “paper promise” of “real value” (98). As Gillray’s successor, Cruikshank was able to see the Restriction narrative through to its grisly end: the cannibalistic Britannia is the tragic climax to the paper assault on John Bullion. The bloated Midas has transmuted into the vampiric mother, and forgery executions are both a literal and symbolic destruction of the democratic body of the nation.

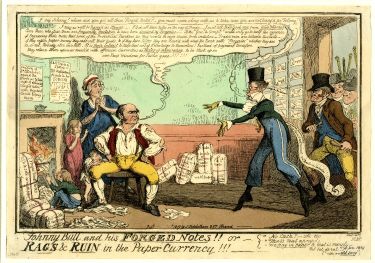

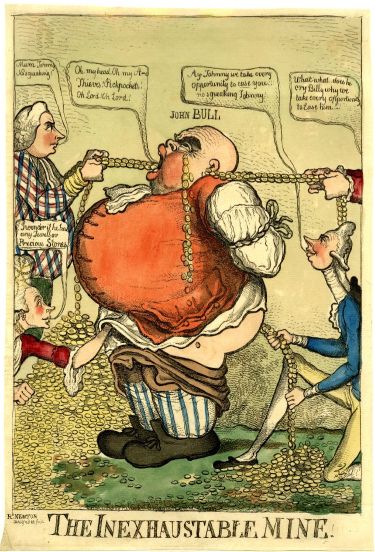

A more optimistic note is struck in another caricature which Cruikshank issued in January 1819. Johnny Bull and his Forged Notes!! or Rags and Ruin in the Paper Currency shows John Bull as a small tradesman rather than a plebeian or yokel (Figure 13). He is about to be arrested in his impoverished home for hoarding forged banknotes, but as he says to the foppish inspector, “I took all these notes in the way of Trade—I can’t tell Bad Good ones from Good Bad ones. Even those who issue them are frequently mistaken & have been deceived by Forgeries.” The debunking of paper money is wittily conceived by reducing the bank notes to combustible paper—this is now their only value. But the most important feature of this print is its portrayal of the Bull family. Far from being abject, Johnny Bull is defiant, sturdy, patriarchal and ruggedly masculine. He is the personification of the moral gold standard, the “real value” of the national character, and he is protecting his “little platoon” against a cowardly and intrusive government. His defiance reflects the resurgent mass radicalism of the post-war years which later in 1819 will confront the repressive state apparatus at Peterloo. His self-belief is a striking riposte to the more familiar caricature figure of a disempowered John Bullion who is constantly duped, plundered and violated by a paper system of taxes, bills and cheap banknotes. The most striking examples of this extreme exploitation of John Bullion are probably Richard Newton’s The New Paper Mill and The Inexhaustible Mine, both published in 1797 as a response to Restriction (Figures 14 and 15). In The New Paper Mill Bull is being minced by Pitt into paper notes (presumably having been stripped of his gold first, though allegorically Bull himself represents “real” money); in the brutal Restriction age, Pitt’s mincer is the modern state’s industrially efficient yet banal replacement for the alchemical bravura of convertibility. The Inexhaustible Mine is an eye-catching, quasi-pornographic inversion of Gillray’s Midas. John Bull’s spouting orifices are not scatologically rendered: they are the result of a violation which conflates a gang-rape, a mugging and a strip search. The image captures the repressive authoritarianism of counter-revolutionary policy in the 1790s, a period in which “the spirit of despotism” led to “invasions of privacy” (Barrell). With these images (and many others) in mind,

Restriction and the ensuing prosecutions for forgery can be understood as the latest components of a wider, interlocking system of mystification, oppression and exploitation which relied on the state’s monopoly of “paper” power.

The state’s rationale for such infringements of civil liberty was that some personal freedoms had to be surrendered if the nation was to be protected against invasion and conquest. Unless John Bullion surrendered his specie and allowed more paper money to circulate, Britain faced an unthinkable fate. If Britons found cheap banknotes unpalatable, they should consider the Jacobin alternative: the rule of the revolutionary French assignat (Figure 16). The assignat was the paper currency which the French Assembly introduced in 1790 out of the proceeds of confiscated Church property.

The policy quickly led to hyperinflation, and by the time the plates which printed the assignat were publicly burned in February 1796, its value had depreciated by an astonishing 95% (compared to about 30% for the pound in the Restriction period).

For Edmund Burke, the assignat was the epitome of Jacobin mischief and the arch enemy of the gold standard. In Pocock’s opinion, it was the introduction of the assignat, and not the invasion of the Queen’s bedchamber, which was for Burke “the central, the absolute and the unforgivable crime of the Revolutionaries” (197). Throughout his Reflections on the Revolution in France, Burke rails against the revolutionaries’ decision “to force a currency of their own fiction in the place of that which is real” (261). He declaims that “So violent an outrage upon credit, property, and liberty, as this compulsory paper money currency, has seldom been exhibited” (226). Overall: ‘everything human and divine sacrificed to the idol of public credit, and national bankruptcy the consequence; and to crown all, the paper securities of new, precarious, tottering power, the discredited paper securities of impoverished fraud, and beggared rapine, held out as a currency for the support of an empire, in lieu of the two great recognized species [gold and silver] that represent the lasting conventional credit of mankind, which disappeared and hid themselves in the earth from whence they came, when the principle of property, whose creatures and representatives they are, was systematically subverted. (126)

’ Burke castigated English republicans and revolutionary sympathizers who believed that England should follow the French example and worship the “idol of public credit.” These misguided supporters of paper currency ‘forget that, in England, not one shilling of paper money of any description is received but of choice; that the whole has had its origin in cash actually deposited; and that it is convertible, at pleasure, in an instant, and without the smallest loss, into cash again. (357-8)’ But as Tom Furniss notes, Burke’s method of “projecting a negative aspect of Britain’s own financial revolution which had haunted it from the beginning onto a radical ‘other’ across the channel” simply reproduced those endemic anxieties about an economy based on what Furniss calls “imagination” (241). So it is both ironic and poignant that Burke died in the year in which Pitt introduced the English equivalent of the assignat (Gillray’s Midas illustrates this irony in the way in which the tiny Jacobin demons swarming round Pitt’s head merge into banknotes). In Burke’s own terms, paper money was no longer “convertible, at pleasure, in an instant, and without the smallest loss, into cash again.”

Yet by freeing paper money from convertibility and the gold standard, it could be argued that Restriction was an unconscious act of modernization, as there was no longer a pretence (or “delusion”) that paper and gold were related (this is surely the case today in so far as no one believes the “promise” on British banknotes to “pay the bearer” the equivalent in gold). By converting currency into “imagination” rather than “real value”, the idea of value migrated into the aesthetic realm, the realm of symbolic circulation. But if Romantic writers remained troubled by the loss of the real, this was not the case for caricaturists, whose work was premised on converting political events into an alternative, parallel and usually controversial fantasy. In this sense, caricature’s generically maverick and ungovernable aesthetics were more in tune with a system of “fabricated pieces of paper”.

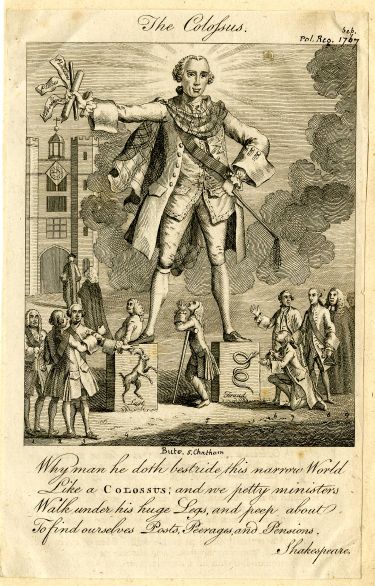

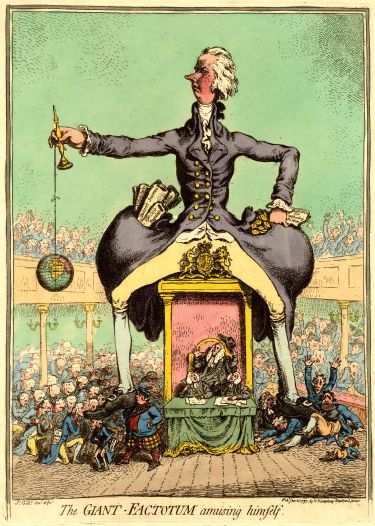

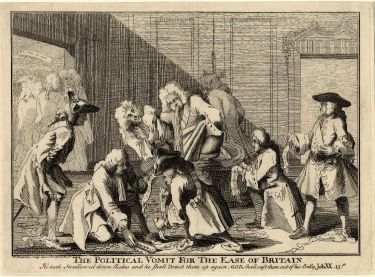

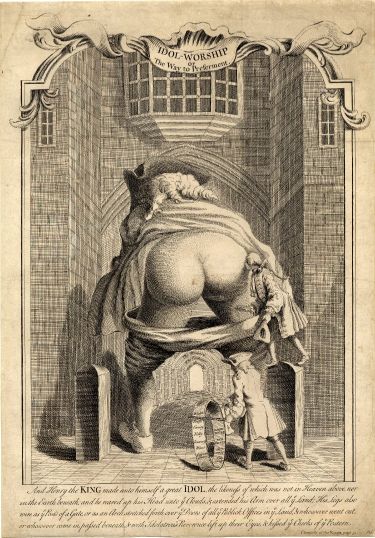

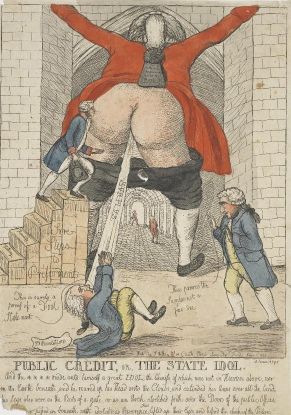

The efflorescent character of Gillray’s Midas seems to register this new creative opportunity. Unlike the macabre Bank Restriction Note, Gillray shows that Restriction was actually a dynamic explosion of paper energy. It is as if Gillray found the idea of unconvertible paper currency irresistible, despite the print’s overt political attack on Pitt’s policy. Another way to think about this apparent celebration of paper circulation is to consider how Gillray innovated upon and modernized his satirical sources, so that we understand more clearly how Gillray constructed Pitt/Midas’s bizarre anatomy. The most immediate influence on his fantasy is the figure of the political colossus. This was a well-honed satirical technique which became popular with attacks on Britain’s first Prime Minister Robert Walpole (Figure 17) and quickly became a familiar visual weapon with which to attack overweening ministerial ambitions such as those of the Earl of Bute (Figure 18). Just a few weeks before the introduction of Restriction, Gillray portrayed Pitt as a colossus in The Giant Factotum Amusing Himself (Figure 19), so the novelty of Midas consisted of the change of venue (from parliament to the Bank of England—a clear hint of the true source of the nation’s ills) and the switch of satirical wit from bawdy pun (‘amusing himself’) to scatological extroversion. For the latter effect, Gillray drew on another popular caricature language in which politicians are depicted scatalogically if not always gigantically. These prints visualize tyranny, patronage and sycophancy by showing the powerful leader shitting or vomiting on hangers-on and suitors. The literary sources of such earthy wit included Rabelais and Swift, but caricature could add the unique extra frisson of visuality. Good examples include anti-Walpolian prints such as The Political Vomit for the Ease of Britain and Idol Worship; or the Way to Preferment (Figures 20 and 21) and James Aitken’s Public Credit, or the State Idol—the latter shows Edmund Burke as the arse-licker climbing the mired pole of preferment (Figure 22). Where Gillray innovates on such sources is his remarkable ability to show Pitt/Midas vacating and ingesting at the same time; metaphorically, this strange physiology registers the credit system’s simultaneous mystification and demystification of paper. As the transparent torso shows, this colossus is anatomically far more agile than his scatological predecessors: he is both hoarding and secreting money, an apt image of “convertibility.” This in itself is a considerable artistic achievement, but Gillray goes one step further in his visual dexterity and allusiveness.

Another popular visual source for Midas is the medieval fantasy of the money devil, a diabolical yet faintly comic figure who exposes greed and covetousness by raining coins onto people from all his orifices. The genesis of this creature can be seen in Hieronymus Bosch’s Garden of Earthly Delights. Next to the so-called “Prince of Hell” (who sits on a toilet-throne expelling people into a diabolical midden) there is a naked rear end ejecting coins into the same pit, a clear association of lucre and damnation. By the eighteenth century the money devil had become a familiar figure in European and Russian caricatures, some of which Gillray may have known (Figure 23). In Midas, however, the cluster of coins which appear to be dropping from Pitt’s posterior like the money devil are actually defying the laws of gravity; they are being sucked up into Pitt/Midas’s torso while banknotes (the new ‘easing’) now perform the lavatorial function—a brilliant realization of the “delusion” of convertibility. As Marc Shell notes, “many people in the eighteenth-century were used to seeing depictions of a coin-covered money devil” but “they were more puzzled by paper money than by coin, so they were especially leery of the new paper money devil’s graphic powers of production, or poesis” (67). Gillray’s genius lies in his ability to imagine this new “poesis” and make Midas a satirical tribute to “the new paper money devil’s graphic powers of production” rather than to the print’s ostensible theme, the “goodness of guineas” (Cobbett, 204).

This contradiction has a wider bearing on the fraught relations between Romanticism and popularity. On the one hand, as already surmised, the loss of “real” currency and the hike in forgery executions made many thinkers mistrustful of the paper money system and for writers and artists these doubts may have extended to the signifying power of “paper” more generally. Simon During describes the post-Restriction mood for Romantic writers as a strange cocktail of “fearfulness, unpredictability, opportunity and weightlessness” (339), perhaps unintentionally echoing Adam Smith’s trope of credit’s perilous “Daedalian” sublimity. Despite clinging to the secure “weight” of bullion, Romantic writers were also impelled to explore new, relatively autonomous and self-authorizing imaginative paradigms which could keep the vexed issue of the tainted paper economy of print circulation and popularity at arm’s length. Though Shelley ventured into Heavy Metal performances in his satires Oedipus Tyrannus; Or Swellfoot the Tyrant (which has a character called “Banknotina”), Peter Bell the Third (which characterises paper money as expropriated bee-honey), and The Mask of Anarchy (which memorably styles the credit economy the “ghost of gold”), such incursions into popular culture were rare.

On the other hand, radical authors like Paine and Cobbett saw the teeming popularity of print circulation as an opportunity for ideological subversion rather than state control. Despite all the government’s efforts to suppress, regulate and neutralize radical writing in the 1790s, Paine was still able to claim (with typical bravado) that Restriction had been precipitated not by the alarm of a French invasion but by the panicky response to cheap editions of his pamphlet Decline of the English System of Finance (Foner, 2: 1387-8). For Paine, cheap radical literature operated like a phoney currency of economic espionage, overloading the system to breaking point. Paper was a medium to be appropriated and carnivalized rather than repressed, displaced or sublimated. When Cobbett asked his readers to flood the market with fake banknotes, he recalled wryly that Pitt had considered deluging France with fake assignats (Black Dwarf, 2 [21 October 1818], 658-9); Cobbett’s Weekly Political Register, 22 August 1818). Like Paine, Cobbett’s phenomenal success cocked a snoop at the new paper economy from within its own ranks: Paper against Gold sold around 150,000 copies, making it, according to Spater, “probably the most widely read book ever written purely on monetary questions” (1: 315). By converting currency into “imagination”, the Restriction Act released its own critique and sowed the seed of its own destruction.

The “formidable” caricaturist

But it was the caricaturists, above all, who could have their Restriction cake and eat it: caricature thrived in a cultural environment in which the boundaries between the “real” and the phoney or fake were being so sensationally and publicly challenged, eroded, undermined and continually flouted. Caricature had a productively contradictory relation to Restriction forgery. To begin with, Horace Walpole’s oft-quoted comment that “all the house of forgery are relations” was much truer of engravers than writers. Walpole made this comment to rebut accusations that his rejection of Chatterton’s request for patronage had led to the latter’s suicide, but he was not alone in seeing a slippage from literary to financial forgery. Joseph Ritson, for example, remarked that “a man who will forge a poem, a line or even a word will not hesitate, when the temptation is greater and the impunity equal, to forge a note or steal a guinea” (Ruthven, 57-9). In fact there was little if no evidence to support this claim, whereas there was abundant evidence that engravers were playing both sides of the law. As noted earlier, the state both relied on and feared the “formidable power of imitation” of the engraver. Ironically, the Bank of England subjected all submitted designs for “inimitable” banknotes to a counterfeiting test by its own engravers: not one design passed the test.

Equally revealing is the fact that one of the eventual solutions to this problem, the use of lithography, was first proposed by the well-known caricature print seller Rudolph Ackermann, yet his suggestion was rejected as “a discovery as applied to the subject of Forgery, infinitely more to be dreaded than encouraged” (cited in Mackenzie, 61).

This takes us the second aspect of caricature’s cultural power. Ackermann undoubtedly knew that the single print caricature functioned like an alternative currency, shadowing and transforming “official” history.

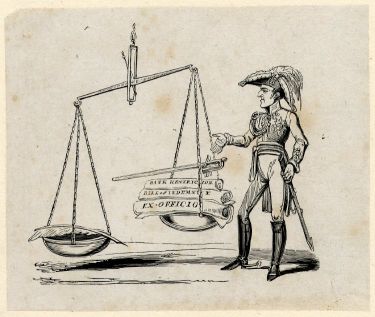

Moreover, society seemed to be imitating art. For critics of the unreformed political system, Regency England had become a caricature of itself, consuming rather than protecting its own children. No event showed this more clearly than the Peterloo massacre of August 1819, an incident which lies at the heart of that extraordinarily productive few years of Romantic literary output which James Chandler (borrowing from Shelley) calls “England in 1819.” But what Chandler fails to note is that these years also represent the crowning achievement of caricature. It is surely no coincidence that the title page of Hone and Cruikshank”s bestselling satire The Political House that Jack Built (1819) shows a pair of scales in which the pen of radicalism outweighs not just Wellington’s sword but a bundle of unjust laws topped by “Bank Restriction” (Figure 24). The image implies that radical critique is the antithesis of Old Corruption’s mystifications, but there could also be an allusion to the Bank Restriction Note of earlier that year. In other words, Cruikshank could be complimenting his own “formidable” imitation of the forged banknotes which (in Baines’ words) were “naturally engendered” by the paper money system and which functioned as an emblem or synecdoche of unreformed political and social structures. This ability to satirically copy a discredited copy of a discredited copy (caricature—forged banknote—original banknote) is a paradigm of the way caricature used its distinctive “imagination” and the medium of paper to critique the “real.”

A third way in which caricature mimicked forgery was that the satirical copy had to be sufficiently life-like so that public figures would be recognised. In essence, this constituted a kind of identity theft in which counterfeit images circulated in place of the original and without the original’s consent. Hone and Cruikshank’s Duke of Wellington is simultaneously real and satirical, his (modestly caricatured) visual identity determined by a few key features such as the hook nose, oversize plumed hat and spurs. Ironically, many Georgian authority figures were known to the public primarily through their caricature representations (Charles James Fox would be the obvious example). As Gombrich and Kris argue, graphic satire’s ability to steal an original identity and manufacture phantom copies tapped into pre-Enlightenment superstitions about magical fetishes which “annihilated” individuality. The reason why “portrait” or personalized caricature appeared so late in history was not, they argue, due to the relaxing of censorship; it has more to do with the secularization of society and the desacralization of the image, its dissociation from actual necromancy. Once this tendency merged with “political allegory”, the result was an explosive release of anti-authoritarian visual aggression (14-17, 26-7). In Vic Gatrell’s words, caricature was “a modernized form of an ancient effigy magic delivered against otherwise unassailable enemies … [a] symbolic defilement anciently embedded in ritual destructions of the defamatory image” (227).

Relatively untouched by legal prosecutions, unburdened by the aesthetics of originality, masterful in creating allegorical fantasies of politics and culture, firmly embedded in reportage and print culture, the single print caricature circulated like a shadow economy of symbolic representation, pumping out “phantom” versions of political leaders, authority figures and celebrities.

Again, there is a useful parallel here with Marx’s theory of the quasi-divine, transformative power of money which “turns real human and natural powers into purely abstract representations, and therefore imperfections and tormenting phantoms, just as it turns real imperfections and phantoms—truly impotent powers which exist only in the individual’s fantasy—into real essential powers and abilities” (378). Perhaps the final irony of the relationship between caricature and forgery is that the restoration of “real value” in 1821 (which in practice meant a return to convertibility and the abolition of the lethal £1 and £2 notes) also marked the decline of the golden age of British caricature. After the success of the campaign to support Queen Caroline, Cruikshank took a huge bribe from the state and retired from the scene.

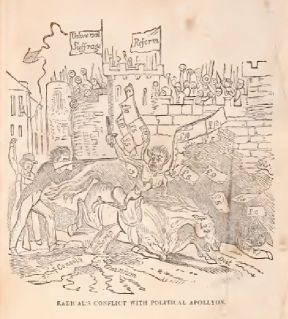

Paper money, on the other hand, continued to be a controversial issue beyond the Romantic period. In 1830, for example, just two years before the abolition of the death penalty for forgery, the Northamptonshire peasant poet John Clare grumbled that: ‘The Speculator is looking for a new paper currency which placed a false value on every species of his traffic & thereby enables the cunning to cheat the honest…I would have every bank issuing one pound notes (which is but a shadow of a promise for a substance which the promiser has pocketed) dependent as Branch banks on the Bank of England. (To John Taylor (1 February 1830); Storey, 498-500)’ The influence of Cobbett over the next generation of radicals who formed the Chartist movement kept the discourse of ‘paper against gold’ alive. In Thomas Doubleday’s satire The Political Pilgrim’s Progress (1839), for example, the hero Radical’s main adversary Political Apollyon is a demon composed of paper money (Figure 25). But given that forgery ceased to be a capital offence in the early 1830s, the debunking of credit lost much of its sensationalism.

To conclude: if Niall Ferguson is correct to say that “Money is not metal. It is trust inscribed” (Ferguson, The Ascent of Money, 29-30), then the key issue remains: who, or what do you put your trust in? If, to quote a popular ditty, “One forgery makes a felon –Millions a statesman!” perhaps you would be wise to invest in caricature.

Works Cited

- “Defoe, Commerce and Empire” The Cambridge Companion to Daniel Defoe Richetti, John (ed.) 2008. Cambridge: Cambridge UP.

- The House of Forgery in Eighteenth-Century Britain 1999. Aldershot: Ashgate.

- Black Dwarf 9 September 1818; 14 October 1818; 21 October 1818.

- Life of Johnson Chapman, R. W. (ed.) 1970. Oxford: Oxford UP.

- Fictions of State: Culture and Credit in Britain, 1694-1994 1996. Ithaca, London: Cornell UP.

- Observations on Mr. Paine’s Pamphlet, entitled The Decline and Fall of the English System of Finance Second Edition. 1796. London: J. Debrett.

- Frozen Desire: An Inquiry into the Meaning of Money 1997. London: Picador.

- Reflections on the Revolution in France 1976. London: Penguin.

- Butt, John (ed.) The Poems of Alexander Pope 1968. London: Methuen.

- The Paper Pound of 1797-1821: A Reprint of the Bullion Report 1919. London: P. S. King and Son.

- “Theatre, performance and urban spectacle [Chapter 21]” Chandler, James (ed.) The Cambridge History of English Romantic Literature 2009. Cambridge: Cambridge UP.

- “Romantic Conspiracy in Britain” South Atlantic Quarterly Summer 1995. 95 (3) pp. 603-28.

- The Bank of England1944. Cambridge: Cambridge UP. 2 vols.

- Paper Against Gold 1815. London: W. Cobbett.

- Cobbett’s Weekly Political Register 22 August 1818.

- Romanticism, Economics and the Question of “Culture” 2001. Oxford: Oxford UP.

- The Truth against the World2007. Cardiff: Wales UP.

- “‘The Ghost of Gold’: Forgery Trials and the Standard of Value in Shelley’s The Mask of Anarchy” European Romantic Review 2007. (18) pp. 381-400.

- The Financial Revolution in England: A Study in the Development of Public Credit 1688-1756 1967. London: Macmillan.

- “Regency London [Chapter 14]” Chandler, James (ed.) The Cambridge History of English Romantic Literature 2009. Cambridge: Cambridge UP.

- British Satire and the Politics of Style, 1789-1832 1997. Cambridge: Cambridge UP.

- The Younger Pitt: The Consuming Struggle 1996. Stanford: Stanford UP.

- The Cash Nexus: Money and Power in the Modern World, 1700-2000 2001. London: Allen Lane.

- The Ascent of Money: A Financial History of the World 2008. New York: The Penguin Press.

- The Character of Credit: Personal Debt in English Culture, 1740-1815 2003. Cambridge: Cambridge UP.

- Foner, Eric (ed.) The Complete Writings of Thomas Paine 1969. New York: The Citadel Press. 2 vols.

- Edmund Burke’s Aesthetic Ideology: Language, Gender, and Political Economy in Revolution 1993. Cambridge: Cambridge UP.

- The Body Economic: Life, Death, and Sensation in Political Economy and the Victorian Novel 2006. Princeton, Oxford: Princeton UP.

- The Celebrated George Barrington: A Spurious Author, the Book Trade, and Botany Bay 2008. Sydney: Hordern House.

- Ossian Revisited 1991. Edinburgh: Edinburgh UP.

- Gentleman’s Magazine July 1780. 50.

- Caricature 1940. London: Penguin.

- The Forger’s Shadow 2002. London: Picador.

- “Romanticism and Forgery” Literature CompassAugust 2007.

- William Hone; His Life and Times 1912. London: T. Fisher Unwin.

- “Forging the Agenda: The 1819 Select Committee on the Criminal Laws Revisited” Journal of Legal History 2004. 25 p. 249–68.

- “Forgery and the End of the ‘Bloody Code’ in early nineteenth-century England” Historical Journal 2005. 48 p. 683–702.

- The Making of History: A Study of the Literary Forgeries of James Macpherson and Thomas Chatterton 1986. London: Associated UP.

- Faking It: Art and the Politics of Forgery 1987. Brighton: Harvester.

- Shelley’s Process: Radical Transference and the Development of his Major Works 1988. New York, Oxford: Oxford UP.

- Essays and Treatises on Several Subjects1758. London: A. Millar.

- “Security by Design: A closer look at Bank of England notes” Secure By Design 24 November 2011. Bank of England Museum.

- The Making of English Reading Audiences, 1790-1832 1987. Madison: University of Wisconsin Press.

- “Forgeries [Chapter 32]” Roe, Nicholas (ed.) Romanticism: An Oxford Guide 2005. Oxford: Oxford UP.

- Romantic Liars: Obscure Women who became Impostors and Challenged an Empire 2006. Basingstoke: Palgrave.

- “Money and Character in Defoe’s fiction” The Cambridge Companion to Daniel Defoe Richetti, John (ed.) 2008. Cambridge: Cambridge UP.

- Deception and Detection in Eighteenth-Century Britain 2008. Farnham: Ashgate.

- The Bank of England Note: A History of Its Printing 1953. Cambridge: Cambridge UP.

- “Forgery, Fiscal Trauma, and the Fauntleroy Case” European Romantic Review 2007. 18 pp. 401-15.

- Forgery in Nineteenth Century Literature and Culture: Fictions of Finance 2009. New York: Palgrave Macmillan.

- Early Writings Livingstone, Rodney, Benton, Gregor (eds.) 1984. London: Penguin.

- “Managing the Gallows: The Bank of England and the Death Penalty, 1797-1821” Law and History Review 2007. 25 (2) .

- Romantic Misfits 2008. Basingstoke: Palgrave Macmillan.

- Writing and the Rise of Finance: Capital Satires of the Early Eighteenth Century 1994. Cambridge: Cambridge UP.

- “Mercantilist Institutions for the Pursuit of Power without Profit: The Management of Britain’s National Debt, 1765-1815” Caselli, Fausto Piola (ed.) Government Debts and Financial Markets in Europe 2008. London: Pickering and Chatto.

- George Cruikshank’s Life, Times and Art. Volume 1: 1792-18351992. London: Lutterworth.

- Paper Money Lyrics 1837. London: C. and W. Reynell.

- Virtue, Commerce and History 1985. Cambridge: Cambridge UP.

- Genres of the Credit Economy: Mediating Value in Eighteenth- and Nineteenth-Century Britain 2008. Chicago, London: Chicago UP.

- English Society in the Eighteenth Century 1982. London: Penguin.

- Report of the Committee of Secrecy of the House of Commons. Ordered to be Printed 15th March 1799 1799. London: J. Stockdale.

- Report of the Committee of the Society of Arts &c. Together with the Approved Communications and Evidence upon the Same, Relative to the Mode of Preventing the Forgery of Banknotes 1819. London: Printed by Order of the Society.

- Memoirs of the Whig Party During My Time1852. London: Longman, Brown, Green and Longmans. 2 vols.

- Fictions and Fakes: Forging Romantic Authenticity 2006. Cambridge: Cambridge UP.

- Faking Literature 2001. Cambridge: Cambridge UP.

- The Economy of Literature 1993. Baltimore, London: John Hopkins UP.

- Art and Money 1995. Chicago, London: Chicago UP.

- An Inquiry into the Nature and Causes of the Wealth of Nations Eighth Edition. 1796. London: A. Strahan, T. Cadell. 3 vols.

- William Cobbett: The Poor Man’s Friend 1982. Cambridge: Cambridge UP. 2 vols.

- The Sublime Savage: A Study of James Macpherson and the Poems of Ossian 1988. Edinburgh: Edinburgh UP.

- Storey, Mark (ed.) Letters of John Clare 1985. Oxford: Clarendon Press.

- “The Currency of Caricature in Revolutionary France” Porterfield, Todd (ed.) The Efflorescence of Caricature, 1759-1838 2010. Farnham: Ashgate.

- The Spectator 1797. London: Longman, Dodsley, Law, Robson, et al. 8 vols.

- An Inquiry into the Nature and Effects of Paper Credit of Great Britain 1802. London: J. Hatchard.

- Times 1 March 1797; 27 January 1819.

- The Political Economy of Sentiment: Paper Credit and the Scottish Enlightenment in Early Republican Boston, 1780-1820 2007. London: Pickering and Chatto.

- Circulation: Defoe, Dickens, and the Economies of the Novel 1988. London: Macmillan.

- Culture and Society 1780-1950 1976. London: Penguin.

List of Figures

Fig. 1 James Gillray, The Table’s Turn’d Published by Hannah Humphrey, 4 March 1797. British Museum Satires 8992. Courtesy Trustees of the British Museum.

Fig. 2 James Gillray, Midas. Transmuting all into [Gold] Paper Published by Hannah Humphrey, 9 March 1797. British Museum Satires 8995. Courtesy Trustees of the British Museum.

Fig. 3 Forged banknote from 1819. British Museum Eagleton 2011, 2012. Courtesy Trustees of the British Museum.

Fig. 4 George Cruikshank, Bank Restriction Note. Published by William Hone, January 1819. British Museum Satires 13198. Courtesy Trustees of the British Museum.

Fig. 5 George Cruikshank, Bank Restriction Barometer Published by William Hone, January 1819. British Museum Satires 13199. Courtesy Trustees of the British Museum.

Fig. 6 Satirical banknote, valued two pence, made payable to “William Pittachio”, one of Pitt’s many satirical titles. Published by S. W. Fores, 1 August 1807. British Museum Satires 10753.A. Courtesy Trustees of the British Museum.

Fig. 7 The Spiritual Barometer. Taken from the Evangelical Magazine 8 vols (London: T. Chapman, 1793-1800), 8 (1800): 526. Courtesy British Library.

Fig. 8 John Ireland (after William Hogarth), Enthusiasm Delineated Published by Isaac Mills, 12 November 1795. British Museum Satires 2426. Courtesy Trustees of the British Museum.

Fig. 9 Abraham Bosse, title page of Thomas Hobbes, Leviathan (1653). British Museum Lothe 1307. Courtesy Trustees of the British Museum.

Fig. 10 James Gillray, The Dissolution, or The Alchymist Producing an Aetherial Representation Published by Hannah Humphrey, 21 May 1796. British Museum Satires 8805. Courtesy Trustees of the British Museum.

Fig. 11 James Gillray, Bank Notes. Paper-money,-French-alarmists,-O, the Devil, the Devil!-Ah! Poor John-Bull!!! Published by Hannah Humphrey, 1 March 1797. British Museum Satires 8990. Courtesy Trustees of the British Museum.

Fig. 12 George Cruikshank, Bank Restriction Note (detail).

Fig. 13 George Cruikshank, Johnny Bull and his Forged Notes!! or Rags and Ruin in the Paper Currency Published by J. Sidebotham, January 1819. British Museum Satires 13197. Courtesy Trustees of the British Museum.

Fig. 14 Richard Newton, The New Paper Mill or Mr Bull Ground into 20 Shilling Notes Published by Richard Newton 12 March 1797. British Museum Satires 8998. Courtesy Trustees of the British Museum.

Fig. 15 Richard Newton, The Inexhaustible Mine Published by Richard Newton, 22 June 1797. British Museum Satires 9025. Courtesy Trustees of the British Museum.

Fig. 16 Revolutionary French assignat, 1792. British Museum G68/17/3/5 Courtesy Trustees of the British Museum.

Fig. 17 George Bickham the Younger, The Stature of a Great Man or the English Colossus Published by George Bickham the Younger, 1740. British Museum Satires 2458. Courtesy Trustees of the British Museum.

Fig. 18 Anon. The Colossus Published 1767. British Museum Satires 4178. Courtesy Trustees of the British Museum.

Fig. 19 James Gillray, The Giant Factotum Amusing Himself Published by Hannah Humphrey, 21 January 1797. British Museum Satires 8980. Courtesy Trustees of the British Museum.

Fig. 20 Anon., The Political Vomit for the Ease of Britain Published in 1742. British Museum Satires 2531. Courtesy Trustees of the British Museum.

Fig. 21 Anon. Idol Worship or the Way to Preferment Published 1740. British Museum Satires 2447. Courtesy Trustees of the British Museum.

Fig. 22 James Aitken, Public Credit, or the State Idol Published by William Dent, 3 June 1791. British Museum Satires 7872. Courtesy Trustees of the British Museum.

Fig. 23 Anon. A Russian print of a money devil, c. 1800-1850. British Museum Popular Prints Russian. Courtesy Trustees of the British Museum.

Fig. 24 George Cruikshank and William Hone, title page of The Political House that Jack Built Published by William Hone, 1819. British Museum Satires 13292. Courtesy Trustees of the British Museum.

Fig. 25 Illustration to Thomas Doubleday, The Political Pilgrim’s Progress, published in The Northern Liberator 1839. Author’s collection.